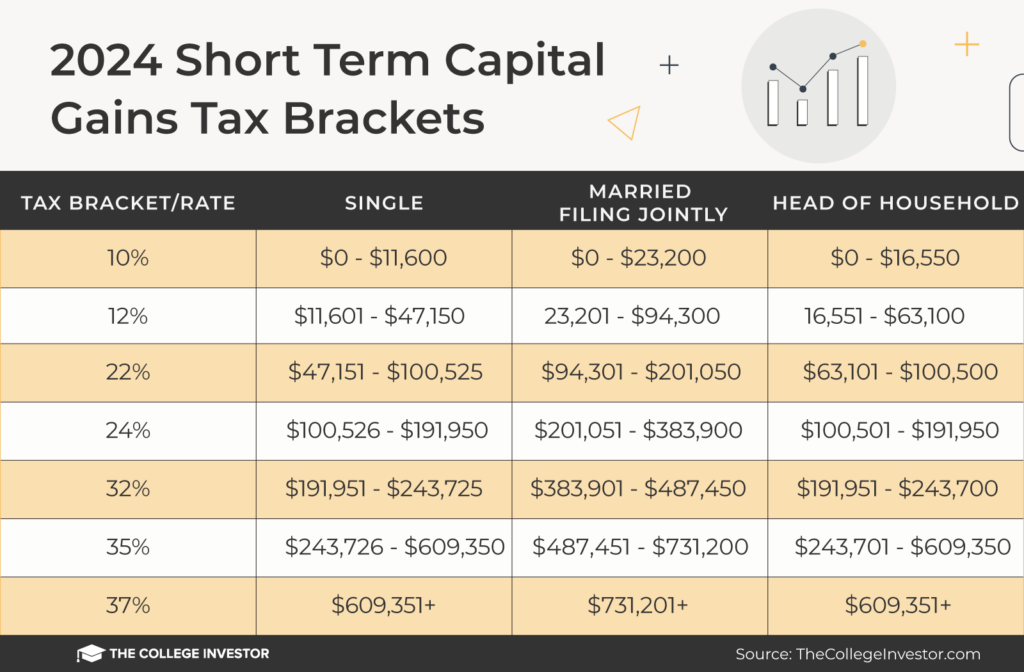

The rate of capital gains tax is 10%, where the total taxable gains and income is less than £37,700. Understanding the upcoming cgt shifts will enable informed property owners to.

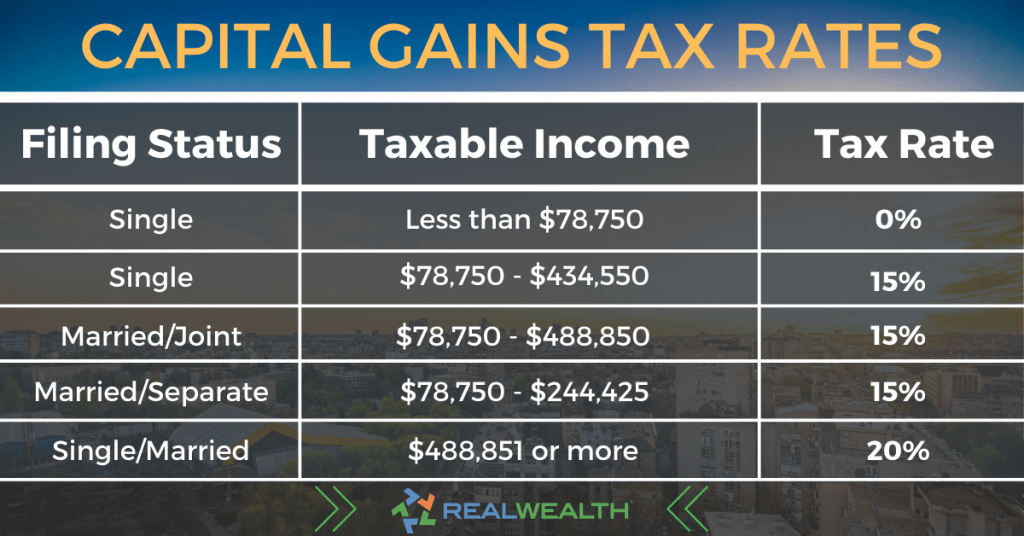

Tax rates and allowances for 2025/24 and 2025/25. The government has announced that the higher rate of capital gains tax on gains from residential property will be reduced from 28% to 24% for gains accruing on or after 6.

2025 Tax Brackets Ireland Cyb Martina, This tax information and impact notice outlines changes to the higher rate of capital gains tax that is charged on residential property gains from 6 april 2025. What is the capital gains tax allowance for 2025/24.

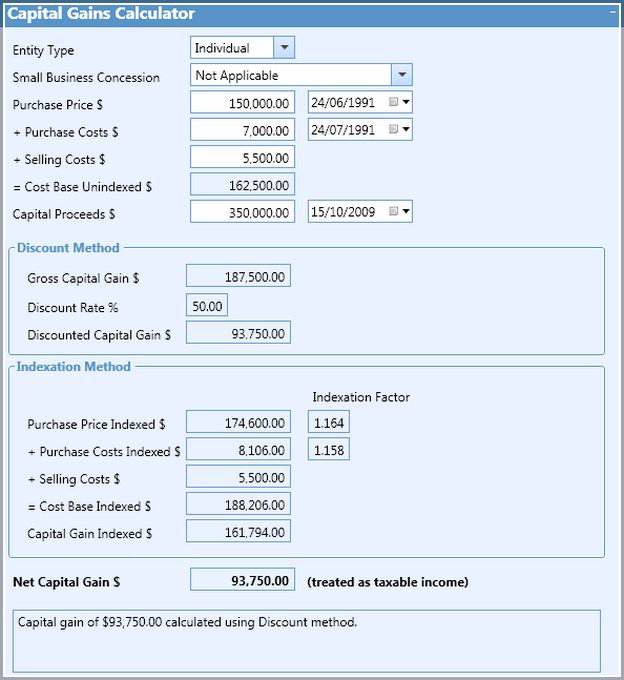

Capital Gains Tax Allowance 2025 24 Ireland Image to u, Capital gains tax annual exempt amount for individuals: This measure changes the capital gains tax (cgt) annual exempt amount (aea).

Capital Gains Tax Allowance 2025/24 Uk Emlyn Iolande, Stephen at the icaew says:. What is the capital gains tax allowance for 2025/24.

Capital Gains Tax Allowance 2025/24 Tera Abagail, In an unexpected move in the budget today, the chancellor announced a cut in the top rate of capital gains tax (cgt), which applies to the disposals of residential. The capital gains tax allowance for the 2025/24 tax year has decreased by more than 50% from its 2025/23.

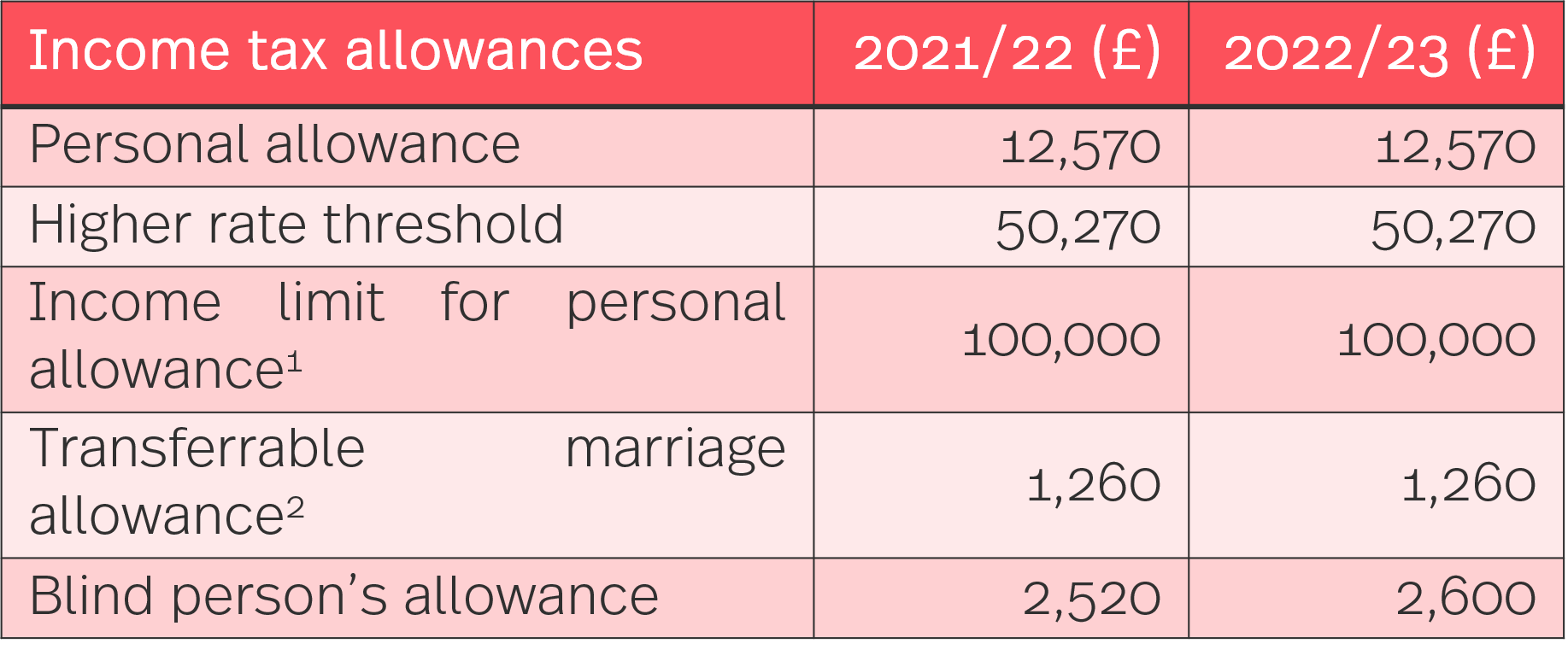

Capital Gains Tax Exemption 2025/25 Marcy Sabrina, Tax rates and allowances for 2025/24 and 2025/25. 1 the individual’s personal allowance is reduced where their income is.

What is Capital Gains Tax and how is it claculated?, Tax rates and allowances for 2025/24 and 2025/25. National insurance is separate from income tax.

Tax On Long Term Capital Gains 2025 Babs Marian, Where ‘business asset disposal relief’. Each tax year, most individuals who are resident in the uk are allowed to make a certain amount of capital gains before they have to pay cgt.

Capital Allowances 202425 Claritax Books, Any excess gains are taxed at 20%. Understanding the upcoming cgt shifts will enable informed property owners to.

Hmrc Tax Rates And Allowances 2025 24 Image to u, Where ‘business asset disposal relief’. National insurance is separate from income tax.

What Is the Capital Gains Tax Allowance for 2025/24 UK? TPBC, Where ‘business asset disposal relief’. The capital gains tax allowance for the 2025/24 tax year has decreased by more than 50% from its 2025/23.

:quality(80))

For the tax year 2025 to 2025 and subsequent tax years the aea will be permanently fixed at £3,000 for individuals and personal representatives, and £1,500 for.